Valeriya Gontareva

Это — перевод заметки «Будни Гонтаревой».

Leaders of the National Bank announced the full publicity and transparency. Hubs asked whether the head of the NBU is ready to pass away a full working day under the supervision of a journalist?

Valeriia Gontareva not only agreed on a working day, but also invited me to visit her at the weekend to meet with the family. Precondition: there will be forbidden access to the meetings where information related to banking secrecy may sound.

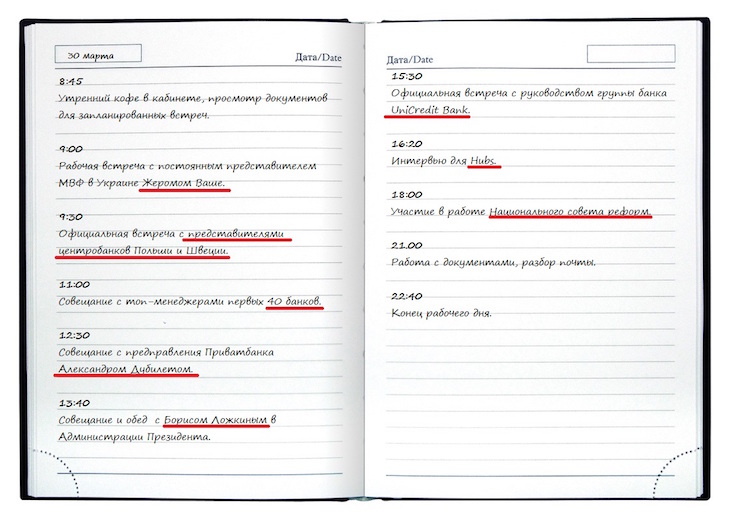

Here is how the Governor of the National Bank spent its working day on 30 March.

«Come into my tiny room of “Geppetto’s cabin”, I want to have a quick smoke before the meeting», — said Gontareva. We pass into the next room. The tiny room looks like a small uninhabited office. The walls are lined with empty bookcases; there are an old sofa and a music center near the window; in the middle of the room, there is a small round table, where a cup of coffee and a cup of green tea for Gontareva are getting cold.

Valeriya Gontareva, at her “Geppetto’s cabin”

An unpretentious cup of tea does not fit into the classical interior of the rec room of the NBU Governor. Later, a waitress confessed that the cup had belonged to her. “Valeriya Aleksyeyevna’s husband gave a present of cup to her; I put it in the coffee maker, and it cracked, so I had to give her my cup”, explained the mannered middle-aged woman with neatly coiffed hair. Gontareva keeps the cracked husband’s gift with the words “Keep calm and carry on” on her desktop.

The cup, her husband’s present, stands on her desk

Gontareva lights up a cigarette, tells about the agenda and opens the folder prepared for official meetings. They are full of the necessary materials, plans of appointments, names, photos and brief biographies of foreign visitors. She has only 10 minutes to study the materials, to have a cup of coffee or tea and to smoke a cigarette.

8:45am — Mrs. Gontareva is getting ready for her upcoming meetings

— Jerome is waiting”, the secretary comes to the rec room. Gontareva runs to the first meeting. Jerome Vacher, the permanent representative of the IMF in Ukraine, came to have a talk with the NBU Governor. The meeting is confidential. As the Governor said, nothing interest was discussed – the usual working moments.

Jerome Vacher, representative from the IMF, is always welcome at the National Bank

Less than ten minutes later, there are new guests in the corridor. Near the small room for negotiations, where the meeting is continuing, an employee of the International Relations Department is nervous. “There arrived Poles and Swedes; the Governor is with Jerome Vacher. What should I do?”, she says somebody on the mobile phone. Instructions come instantly; the guests are led to the buffet to have a cup of coffee. Punctual Europeans arrived 15 minutes before the meeting with suitcases in their hands: from the NBU, they immediately go to the airport.

The meeting ends at 11:03. In the large conference hall, 40 heads of the largest banks are already waiting. The hall is not far: there is a separate door from the reception hall. During those busy months, when the hryvnia was falling sharply, meetings were weekly. The bankers made themselves familiar with the conference hall. Each of them has its own seat around the table. The Chairman of the PrivatBank Aleksandr Dubilet is sitting just opposite Gontareva; on his right hand, there is the head of the Oshchadbank Andrey Pyshnyi. Since March, the meetings have become rare, once every two weeks.

The bankers’ meeting is being held at the grand conference room

Passions at the meeting subsided following the panic on the market. The bankers tired of the crisis calmly listened to Gontareva, her First Deputy Governor Dmitriy Sologub, and Director of the Legal Department Viktor Novikov. The bankers were told about legislative initiatives that will move through the Parliament, possible abolition of the 1.5% military duty when performing FX transactions, and overall macroeconomic situation.

— What do you have?, — Gontareva asks bankers.

«We do not see any pressure on the FX market”, Aleksandr Dubilet from the ProvatBank shares observations. — If military actions subside, the exchange rate will be stable.” His collegue, Andrei Pyshnyi from Oshchadbank, agree with him, “We do not expect strong demand on the FX market – retailers’ revenues are falling. Everything is calm and usual.”

Gontareva warns that the NBU plans to reduce the discount rate, so it will be better not to set high interest rates on long-term deposits. The meeting ends with applause. Gontareva thanks Chairman of the bank “Credit Agricole” Yevgeniya Chemeris for her contribution in the development of the banking system. The NBU Governor kissed her retiring colleague on both cheeks (on the next day, Hubs interviewed Yevgeniya Chemeris). Dubilet and Pyshnyi photographed them on phones, and other bankers applauded.

The bankers’ meeting. Gontareva is presenting the award to Yevgeniya Chemeris

The NBU Governor announced the next appointment in two weeks, said goodbye and ran into the office. Dubilet and First Deputy Chairman of the PrivatBank Oleg Gorokhovskiy were already waiting for her in the reception room. The PrivatBank has been defending itself from the information attack during the whole week. Its customers were receiving sms and calls warning about the forthcoming demise of the bank. There were appearing false statements of former employees of the bank about its submarginal condition. The customers responded. Dubilet and Gorokhovskiy put the folders with the documents showing outflows of funds from ATMs. The meeting was confidential, so I could not be present at it. The result of the meeting was as follows: the PrivatBank received moral and material support from the NBU (the next refinancing tranche).

The meeting with Alexander Dubilet is held under casual circumstances

Having sawn the PrivatBankers off, Gontareva went to a meeting with the head of the Presidential Administration Boris Lozhkin. The meeting has appeared suddenly in the schedule. Instead, we had a scheduled dinner with Gontareva and Pisaruk (first deputy governor Alexander) in the dining room of the National Bank.

Pisaruk did not refuse the dinner. Taking with us Deputy Governor Yakov Smoliy, we went to taste NBU delicacies. There is a separate dining room for the members of the NBU Board and directors of NBU departments. The interior decoration of the room resembles the decoration of the former prosecutor general Viktor Pshonka’s house. The first impression was the following: the room was prepared for wedding; there were white tablecloths, violet placemats, pink lace curtains on the windows, walls painted with flowers, and chairs with cushions.

Dining area at the National Bank — the executives room

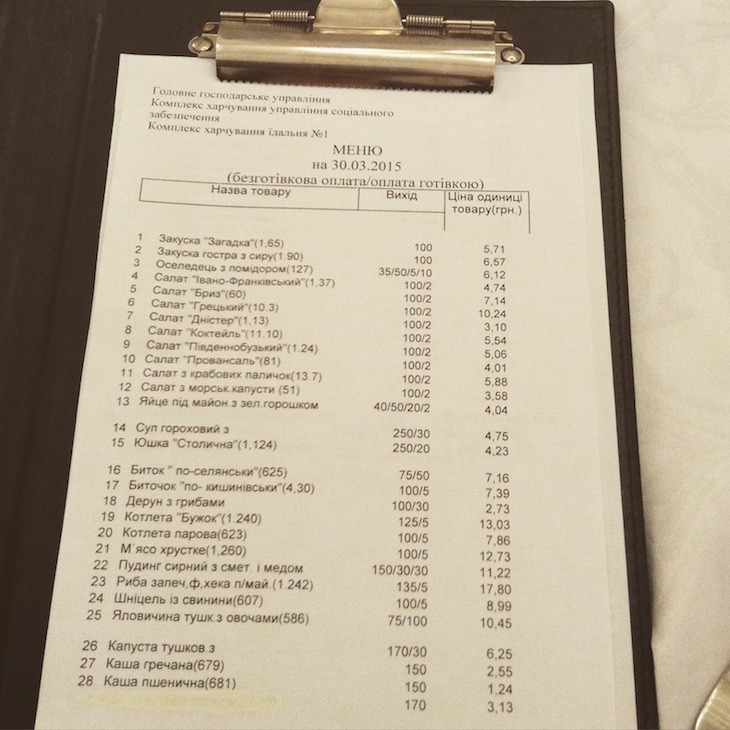

There was the menu on the table: salad “Dniester” – 3.1 hryvnias, pea soup – 4.75 hryvnias, buckwheat groats – 2.55 hryvnias. Baked fish was the most expensive dish on the menu – 17.8 hryvnias. Each employee of the NBU can open a deposit account in the dining room. Money for the dinners will be charged off from the account. You can also pay by cash; the check is given to you. The menu for the NBU leaders is identical with that for ordinary employees. The only difference is in servicing. The room for ordinary employees is self-service, whereas for the leaders, a waiter serves up and takes away.

The dining menu is the same for everybody

We sit down at a long laid table and make orders. While a waiter serves the dinner, we begin to talk with Pisaruk.

Aleksandr Vladimirovich, you are friends with Gontareva for a long time. Is that why you took her offer to work for the good of the country?

The personality of Gontareva played one of the key roles in my decision to return in Ukraine. Many people came work in the NBU because she called them, this is not only my own experience. This confirms her reputation. Patriotism and professional challenge are two more reasons why I accepted the offer.

Does friendship interfere in the work or not?

No, it does not; we have learned to demarcate labor-management and personal relationship. Mrs. Valeriya is organic in relationship, both at work and outside of it. Moreover, the sense that we are doing a common cause brings us together. If I had not accepted the offer of Mrs. Valeriya, I would be very sorry. I would feel that I had done a bad turn.

In 2000s, you were Gontareva’s chief. Now, she is your chief. Was it difficult to change places?

It was easier than one can imagine. Hierarchical relations hardly felt.

What is Gontareva’s style of management?

It is the male style. Solely the emotional palette differs. Mrs. Valeriya see shortcomings, exaggerates them slightly, and requires to urgently remove them. She is very exacting to herself and to people around her. Honesty, adherence to principles, and purposefulness are her main strong features.

And what about the negative ones?

She focuses on results and does not appraise the importance of the process itself. She manages the results, whereas she should manage also the process. She requires prompt actions, but the old system does not allow us this yet.

We discuss female and male style of management. Smoliy explains the difference on the simple example.

My wife and I really love to cook, but we do it in different ways. She can cook four dishes at the same time, keep the situation under control, nothing will be burnt by her; however, it seems to me that the kitchen is a shambles. On the contrary, my structure of cooking is linear: I cook one dish after another, and the kitchen is absolutely fine. Our results are identical; only the process and the time differ.

The common dining area at the National Bank

The dinner is over. We are having a cup of hot tea. We do not want the leave the warm dining room. In the National Bank, the workers cut off heating for the weekend, so on Mondays, it is cold here. Almost all the women wear tippets, scarfs, or headscarfs.

Gontareva has already have lunch with Lozhkin. Chairman of the Ukrainian “daughter” of the UniCredit Bank Craziano Cameli, his First Deputy Head Tamara savoshchenko, and financial director Giacomo Volpi are waiting for her in the little room for negotiations. An increase in the authorized capital of the bank is the theme of the meeting. An employee of the International Relations Department and I remain at the back of the door.

Do so many foreigners often visit you?

This is not so many. Sometimes, there are 12 delegations per day. Not all of them come to the Governor, but the majority of them do it.

We hear the loud laughter of Gontareva. The door opens, and the faces of the bankers show that the results of the negotiations were positive. A few days later it became known that the capital of the UniCredit Bank was increased by USD 500 million.

Meeting with UniCredit Bank’s management was successful. The Italians have invested more capital into their Ukrainian subsidiary

The NBU Governor is ready to be interviewed. In the reception room, the furniture was moved. Two armchairs for guests and a coffee table were removed, and the corner of a guard appeared on their place. A tall strong young man is watching the guests carefully.

Your security is serious…

At first, I have no security at all. I went to work driving the car myself, as I did during the last 18 years. Then, after threats began to come, I was transplanted to a company’s car with a driver and received bank guards; when the situation worsened, the bank security was replaced by the State Security Administration.

Two heavy wooden doors lead to Gontareva’s office from the reception room, each having about three meters in height. To open them, you will need a magnetic card. The spacious office is divided into three areas: the working place, a place for meetings at a large round table, and a place for recreation with two leather armchairs and a coffee table. We sit down at the round table, at which the NBU Board gathers every Thursday. Just here there was deciding the fate of 47 banks, which were withdrawn from the market from the beginning of the previous year. Gontareva asks for a cup of green tea with honey, but instead of honey, she gets three small bars of chocolate Roshen.

”No cell phones” signs can be seen everywhere in the building

Who did you cross the road?

We withdrew the banks laundering money from the market. This is a criminal segment. Naturally, the owners of these banks were disaffected. Have you seen those meetings with slogans “resignation-court-prison” against the NBU walls? There are disaffected persons among MPs. MP Maksim Polyakov from the party “Front Zmin”(now named “Narodnyi Front” party) says on all channels that Gontareva is the chief corruptionist of the country, that she stole USD 7 billion, bought an island and took her family off there. By the way, we have already had the “Island”. It is in Irpen, and my family lives there for 15 years.

I believe that I can change the NBU and the banking system. I have to do this.

You are threatened; somebody organizes meetings, makes provocations in the Verkhovna Rada. What keeps you from leaving your job?

The question is not what keeps me but why I came here. The task has not changed. There have not been unsuccessful projects in my life. I believe that I can change the NBU and the banking system. I should do it. If government officials will easily give up because of the provocations in the Rada, who will rebuild the country?

How many times have you wanted to leave the NBU?

I have never written the statement, but I had the desire to leave.

What was the reason?

Gontareva lowers her eyes keeping a long pause. The smell of smoke is coming through the open window. A dozen of borrowers, who have credits in foreign currency stoke wood in barrels directly outside her office. They are not as active as in the beginning of the year, do not beat barrels, and do not cry, «Shame!» And a special vehicle with horns has not been seen near the National Bank.

A sense of hopelessness. There is a good phrase: “Well, if you break the wall of the cell with your head, what will you do in the next cell?” It seemed to me that only we were tuned in to a wave of changes, whereas the world round us did not want to change. I thought that everybody will run, whereas solely the National Bank has started. This was especially sensed on the New Year eve, when we were turning into white crows. And I would like to ask, “Who is a real kamikaze?”

The view from the Head’s office. Down below, the borrowers, who have credits in foreign currency are getting bored in their tents

What has changed?

All has begun to change since the accession to an office of the new ministers in the government. They were getting into the swing of things for a while, and then, they also started in the right direction. Now we see that the Minister of Economy, Minister of Finance, Minister of Transportation, and Minister of Energy are in their respective places. We felt better.

Did you start to run together?

We see ourselves as an older brother, because we started early and long run ahead. But they may harness longer and then quickly run.

At the last press conference you have said that you were waiting with impatience when the government would start reforms and take a portion of criticism away on itself. Has it taken?

Surely. Now all the criticism is on its territory. Now we have another “main characters” viz. Yaresko who raises taxes, Demchishin who makes the reform in the energy sector, and Aivaras who began to speak on privatization.

What is the most painful criticism?

Lies, twisting of facts, fictions, manipulation of figures hurt the most.

Gontareva at her work desk

Pisaruk said that honesty, adherence to principles, and purposefulness are your main strong features. Is it about you?

I often quote the movie «Brother 2»: «Where is the strength, brother?» «In truth!» So I think that the strength is in truth. It’s like in the Old Testament: «Riches will do you no good on the day you face death, but honesty can save your life.” In my opinion, everybody going into politics or the civil service should have only two essential principles: not to lie and no to steal. It’s very simple; there is no need to suffer with a choice: it is clear every time. I agree with my “purposefulness”; I understand what the result of our work I want to see. It is clear that not all of us are doing the right thing.

What mistakes have you made?

There were a few technical errors. For example, bankers offered to pay foreign currency transfers after opening a foreign currency account, whereas without opening the account, in hryvnias. The proposal was sensible; we have introduced such a rule and got a lot of criticism. We were told that the NBU takes all the money from migrant workers. We had to cancel the rule.

Has the rule been cancelled due to criticism?

This limitation made a small positive impact. A negative impact was much more. But as regarding bank cards, we did not give up: nobody can receive foreign currency from ATMs.

— What about serious mistakes?

— I think we had to clean the banking system more quickly. But here we were hampered by the operational capabilities of the Deposit Guarantee Fund. It could not immediately «digest» such the number of bad banks.

— Do you agree administrative measures with the IMF?

— To enter the last administrative measures the IMF mission headed by Nikolai Georgiev came. They brought their experts on restrictions on the FX marketand on work with exporters and importers. Their help was to the point. But in Ukraine, the situation is unique. Even the World Bank and the IMF hardly understand how to act. Besides the usual crisis in the economy we have a strong destabilizing factor — military actions.

— Who share responsibility for the devaluation of the hryvnia with the NBU?

— Responsibility for the devaluation is primarily attributable to imbalances accumulated in almost all areas of economic life of the country for the decades, and only then, the military conflict is responsible. Add also the Customs that passes illegal imports; Tax Administration that does not see a problem of transfer pricing, and the judicial system that covers the illegal business of money-laundering.

No wonder that I compared myself with a stewardess (she laughs). The NBU has a limited set of instruments. We cannot change the balance of payments of the country. The National bank is not an importer, not an exporter, not the Customs, and not the tax Administration. We can use administrative measures and prohibit or restrict something, but the task is opposite – to liberalize the market. And how can we liberalize it, when the pilots of the aircraft are doing nothing?

The new National Bank’s team has been equipped with webcams

— What is the stewardess doing during this time?

— The stewardess can tighten belts — our administrative measures, pour some water to passengers — our verbal communication, and feed the passengers on the road — our interventions on currency sales. But we should really pull the economy out of a dive!

I stand for the liberal market, but in the latest six months, it is necessary to introduce administrative restrictions. On our part, we did all we could. Now we are finishing the cleaning of the banking market. Then we will restart the system. But all will be in vain if there is no protection of customers’ rights, if courts do not work, and if GDP do not begin to grow. We still have to keep the draconian refinancing rate – 30%, because there is the threat of unwinding of inflation is rather high. We need available financial resources for the economic growth.

— The situation with the hryvnia exchange rate has stabilized – the hryvnia is kept at 23 hryvnia almost for a month. Due to what?

— Administrative measures cut off illegal business attempts to enter the market and buy the currency. In addition, the National Bank of Ukraine became an active participant in the market: we sell and buy when it’s needed — adjust supply and demand. We bought USD 600 million on the interbank market and plan to give them to the market; we are not going to replenish the reserves with this money. At present, our reserves total nearly USD 10 billion.

What rate can balance the current account?

The corridor was not changed – UAH 20 – 22. At this level, the purchasing power of imported products is significantly reduced. Now is the right time to start import substitution. Unfortunately, the bankers do not yet see demand for loans for business development on import substitution.

One of the seven old telephone sets of special communication sounds shrilly. It has no buttons nor disk, only the tube.

— Vladimir Borisovich, good afternoon! – a broad smile appears on the face of the NBU Governor. Chairman of the Verkhovna Rada Volodymyr Groisman is on the wire.

Gontareva’s tone became so sweet that even Scrooge McDuck could hardly deny her. Despite the male style of management, Gontareva can use her personal charm, when it is necessary. She asks Groisman to include six very important for the NBU bills to be considered during the next session of the Verkhovna Rada. There is no choice for the Chairman, and he agrees. At the same time, he is interested in refinancing of state-owned banks. Gontareva explains him the procedure of prolongation of debts for Ukrgasbank and Ukreximbank and calls the current rates. The shor conversation is coming to an end. Last week was sessional. Groisman has fulfilled his promise.

Vladimir Groyssman is on the line

— Did you feel that you came under pressure from business? The businessmen loyal to the NBU’s policy were in the minority at your meeting held at the American Chamber of Commerce.

— Yes, it is true. However, there were a lot of those who back the NBU’s policy at the meeting with the representatives of the European Business Association. The associations bring together western business companies that are mostly reliant on import. They were hit hardest by the hryvnia’s depreciation. We are trying to convey to importers that a clampdown on the illegal businesses might affect lawful businesses that are now required to submit a lot of certificates (notices) and open a letter of credit (use a letter of credit payment method for settlements). We have imposed a ban on issuing loans in hryvnia if they are issued for the purpose of using them to purchase foreign exchange. Many companies have used this instrument as a hedge against the currency depreciation. Of course, they are not happy about this restriction.

We have recently met with oil traders. They were filled with indignation at the restrictions and asked us why we had imposed a requirement to use a letter of credit payment method for settlements, which adds complexity to doing business? They have now acquired an understanding that these measures will help eliminate illegal imports or smuggling, and ultimately put an end to illegal competition. They are now ready to make an effort to get extra certificates (notices) issued and wait for a couple days.

In your previous job in business there were people with whom you got on well, and those with whom you didn’t. Has your previous experience influenced the decisions that you have made since you came to office as NBU Governor?

— The banks that we have put into resolution belong to different business groups. So, it is obvious that we treat banks equally. We have never had and will never have «special relations» with anyone.

— Has the situation changed since the law designed to increase the liability of bank owners and people closely associated with a bank’s management was passed by the parliament?

— It is not the word! All the shareholders are now aware of the requirement to increase banks’ capital. Otherwise, the bank will be put into resolution and withdrawn from the market, and its shareholders will liable for their obligations with all their property.

— The National Bank of Ukraine has put one of the biggest banks Delta Bank into resolution? Is the market gripped by panic?

— We had fears that that the situation would become more complicated further after Delta Bank’s resolution – a new wave of panic and deposit flight would grip the market. Fortunately, our dire forecasts have proved wrong. The situation surrounding Delta Bank has a long history, and the market has long been waiting for our decision to wind up this bank. We have been trying to rescue this bank and have held a series of meetings with the Ministry of Finance of Ukraine, the IMF, and the World Bank. Delta Bank met all criteria to be qualified as systemically important bank and ranked fourth in this group of banks. We believed that that it should be nationalized.

— What went wrong?

— The Ministry of Finance of Ukraine was unwilling to nationalize one more bank. Our previous experience in recapitalizing banks has shown that the state (government) is not the best shareholder. In 2009, we nationalized three banks, and only one of them Ukrgasbank operates in a sound manner now. Bank Kyiv was almost unviable, what is left from it merged with Ukrgasbank, let alone Rodovid Bank, which is a remedial bank. We will decide its fate soon.

— In 2009, were a lot of talks about plans to nationalise Nadra Bank. The National Bank has already put it into resolution and removed it from the market.

Similar to Nadra Bank, the issue related to Delta Bank had remained outstanding for a long time. However, the bank met its current obligations until the last day. The stress-testing exercise has showed that Nadra Bank was undercapitalized and required additional capital worth UAH 11 billion to be fully capitalized. However, the shareholders fell short of funds, and an attempt to find foreign investors failed. So, when 180 days required by the applicable laws had passed, it was decided to put it into the hands of the Deposit Guarantee Fund.

— How much does Nadra bank owe to the National Bank

— The National Bank provided refinancing loans to this Bank for a total of UAH 12 billion, The bulk of these loans was issued in 2008, and has never been repaid.

Publications available in Head’s reception area

— Does it mean that you have written off UAH billion for Nadra?

— Less than this amount, as provisions in an amount of UAH 9 billion had been set aside in respect to Nadra Bank, and the remaining amount of outstanding debt is secured by collateral.

— Does it mean that when it comes to refinancing, the National Bank pursued a risky policy in 2008-2009?

— There was no policy at all.

— You meet with NBU former governors on a regular basis, do you? Did you ask them how they could afford such «generosity»?

— I came to the NBU to build a new life for Ukraine’s banking system, rather than blaming «predecessor» for all problems.

— Did Kubiv tell you why he had extended so many refinancing loans to banks?

— Kubiv faced a challenging situation. When we came to the NBU, we had time to carry out stress-testing of 35 largest banks, so we had a clear picture of their problems, approved recapitalization plans for banks, and had a clear understanding of whether we can help each individual bank. Can you imagine Stepan Kubiv, who did not have this opportunity? He was unaware at all of what was going in banks, and what problems they faced. It can be said that he had to help banks with his eyes tied with black, as banks suffered heavy deposit outflows in March-April, and the situation and had to be addressed promptly.

— Have banks belonging to Group 1, and 2 undergone a clean-up procedure yet?

— No, the clean-up exercise is still underway. Pisaruk promised to complete purging the banking sector in two or three months. We will ask him in July whether it has been done.

— How many operating banks are left?

— We are not able to give you this figure. We are set to keep afloat all viable banks. Only those banks, whose shareholders are not prepared to inject additional capital to get them fully capitalized, will exit the market,

— When will we see the result?

— The banking sector has almost been cleaned up, pending to be rebooted. The NBU reform is gaining momentum. One step separates us from the breakthrough.

Valeriya Gontareva’s workday schedule

There are a lot of questions left unasked, but out time is running out. Gontareva is being waited for at the National Reform Council. Mass media representatives are not allowed to attend it. The Governor of the National Bank of Ukraine is putting on her coat and asks us not to wait for her. The Council meeting might stretch until midnight. She is extending her hand for a handshake and promises to take a selfie near the clock in her office when she will be leaving for home.

Evening. 18:00. Life is bustling at the National Bank. 1400 employees are rushing towards the building entrance.

«New blood» has branded occurrence as «mass exodus». It was not common and was not allowed to stay at work after the end of the working day at the National Bank. Most employees have passes to get into the office, allowing them to stay inside strictly from 9:00 till 18:00. If you break they rule and stay at work longer three times, you risk being told off by the security offices. After receiving a good deal of reproaches from the security offices, a new team of managers was able to change the rules and get passes extended, allowing them to stay unlimited at work 24/7.

The clock is getting closer to 19:00. The National Bank is falling into darkness. For energy-saving purposes, light is switched off in the corridors of the bank. It is a typical occurrence to run slap into one of your colleagues or meet somebody with a torch.

It is empty, dark; the floor is creaking under your feet. The light is on only on the third floor. Gontareva promised us to return to office.

Later Hubs received a photo of Gontareva standing under the clock. Gontareva is not social network visitor, she has not learned to take selfies the right way.

The end of the day. During her first six months as the Head of National Bank, Gontareva’s has been leaving work after midnight

On April 5, 2015, Hubs spent the whole Sunday with the NBU Governor. You will find out how she spends weekends, which sport she is fond of, where she buys clothes and what she likes to cook in the next issue. One of her family pets is the cat of Devon Rex breed. It is called Elf.

Elf the cat